Say Goodbye

to Banking Hours

Say Hello

to Global Business Partnership Banking

Global startups, entrepreneurs, and legacies alike rely on Deltec to provide uncompromising service.

Banking that powers

the global ambitions of businesses

The Future of Finance

The Deltec Network

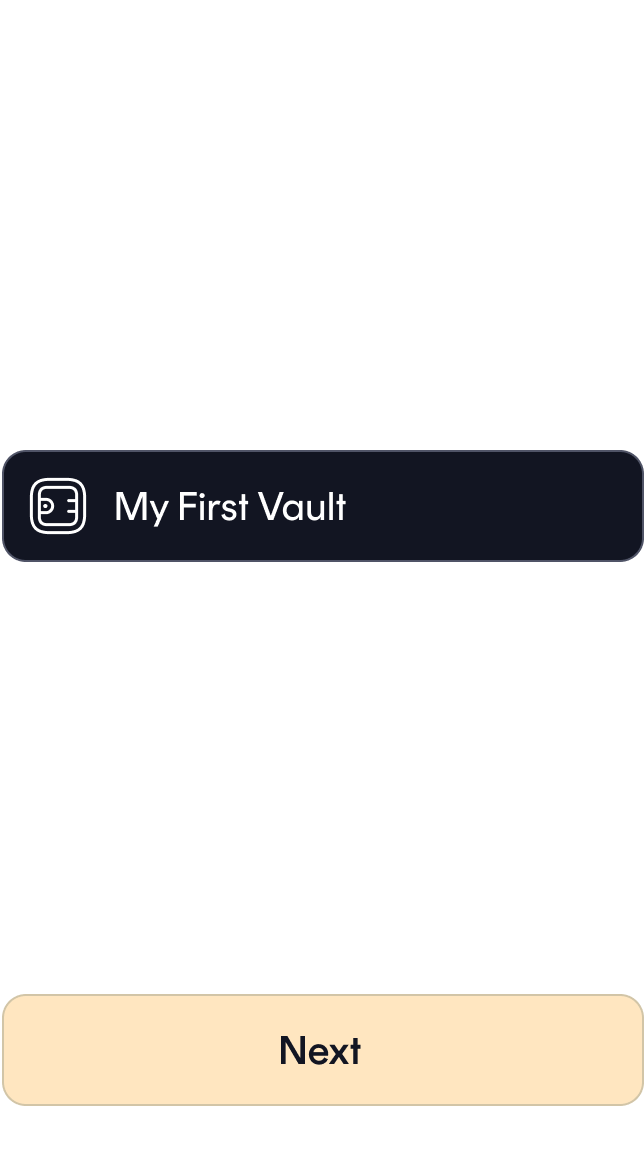

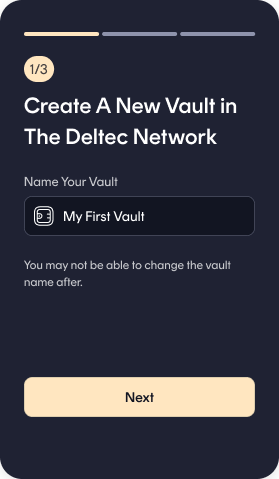

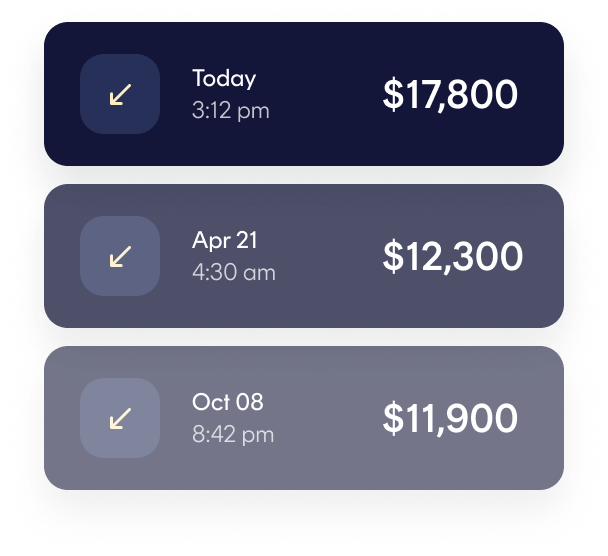

- Create A Vault

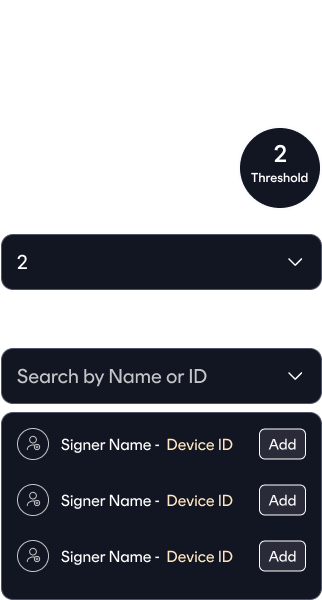

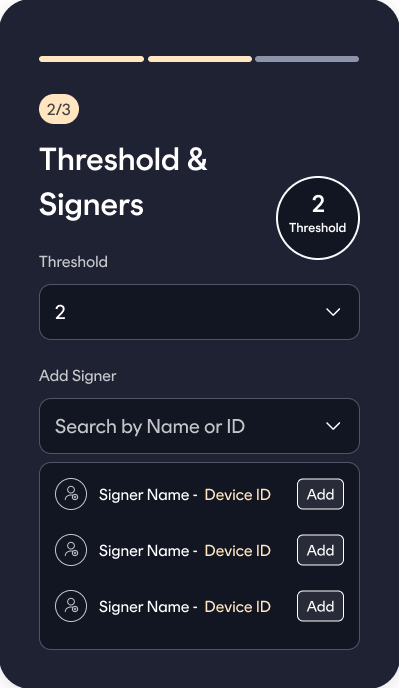

- Define Thresholds

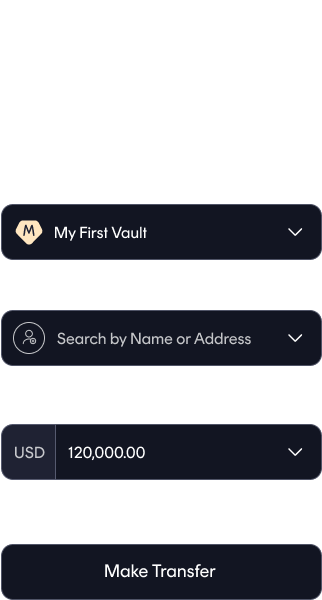

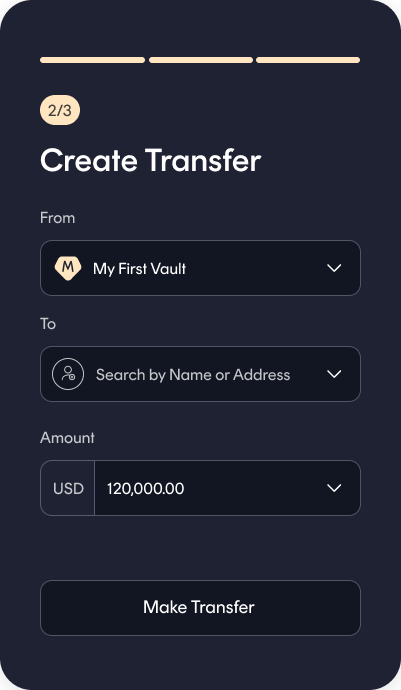

- Send & Receive Instantly

- Done & Back to work

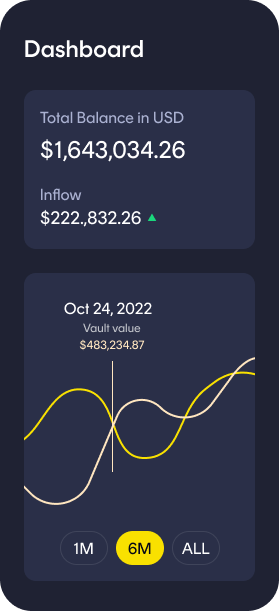

Safe & Secure, 24/7/365

In-Network Transfers

The Future of Finance

The Deltec Network

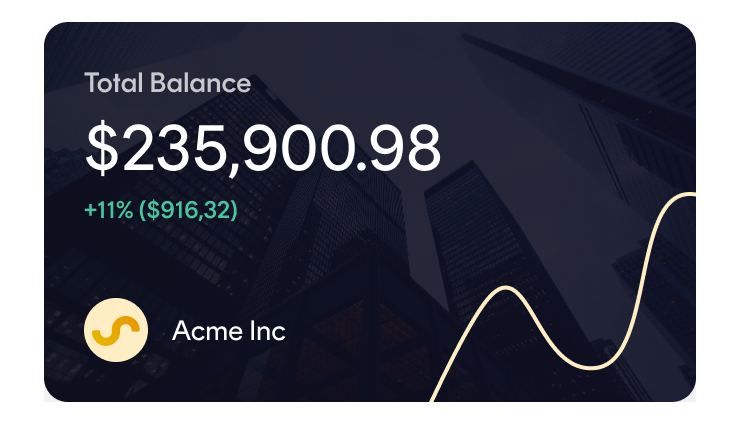

Mobilize quickly

Store, send, and spend across multiple currencies.

Apply for an account easily and 100% online

Access and manage accounts online

Pay global suppliers or employees, at competitive rates

Do business with ease

Take advantage of our streamlined web and mobile portals.

Grow with a Strategic Business Partner

Dedicated advisory to navigate any business challenge

Services & Global

Payment Rails

A Dedicated Partnership

Secure and manage global transactions and payment flows with banking services built for rapidly scaling businesses.

Business Solutions

Our team of specialist advisors bring you strategic business solutions such as:

- Liquidity/Asset Management Solutions

- Debt/Equity Solutions

- Tailored Payment and Card Solutions

- Compliance-as-a-Service

We partner with entrepreneurs to optimise corporate liquidity, invest in their goals, build their teams, and realise their vision of the future.

Connected Network

With the Deltec International Group, access even more opportunities:

- Fiat and Alternative Investment Solutions*

- IPO Support

- Business Relocation Services

- Tax Planning

- Fund Structuring, Formation & Administration**

- Deltec Private Banking

* in partnership with Delchain

** in partnership with Deltec Fund Services

Join a legacy of entrepreneurs

Trailblazers and veteran paragons alike call Deltec home.

No question left unanswered

Deltec has a 75+ year history of financial stability, a highly-disciplined approach with billions in assets under management, and a team of over 100-people – with globally respected portfolio managers, investment analysts, economists, strategists, traders, trust officers, lawyers and certified public accountants.

The security of our clients’ assets, and our financial security as a bank, is the cornerstone of our business model. We carry no debt, no proprietary trading*, no commercial loans, and no leverage. We remain conservative in our credit policies and our commitment to sound capitalization. And we adhere to stringent regulatory and capital requirements.

* We do not operate a balance sheet based banking model. This means we do not make our money by earning interests by investing our clients deposits. We generate income on fees for offering excellent banking services. This means the Bank will never be exposed to a liquidity/maturity mismatch that caused the 2023 banking failures.

Deltec has zero risk exposure to crypto. Deltec has taken a position to advocate for pioneering innovators who are working to find novel solutions to some of the world’s challenges – some of which digital currencies seeks to resolve.

Deltec Bank does not provide digital asset services. Deltec Bank neither holds nor trades digital assets for its own account or on behalf of our clients.

The Bank provide traditional private and corporate banking, investment and wealth management, trust, and fiduciary services to global entrepreneurs, creators, and innovators.

Our clients choose us for our demonstrated expertise in managing and advising on complex, global affairs across their personal wealth and professional endeavors.

We’re particularly good at helping high net worth individuals and families to navigate challenges and leverage opportunities created by globalization, development of new industries and/or the evolving landscape – ensuring continued compliance with the international laws and regulations.

Entrepreneurs and families have trusted Deltec Bank for generations. You can rely on Deltec Bank to be there at every stage of your financial journey — and as fiduciaries, we have a duty to always put your interests first.

Our expertise in global financial markets and structuring wealth for generations have made Deltec Bank a leading institution, while our conservative strategy, strong balance sheet and history of profitability make us a secure and stable partner.

This means the Bank will never be exposed to a liquidity/maturity mismatch that caused the 2023 banking failures.